2022 tax brackets

You can work with a financial advisor who specializes in taxes to craft a. 13 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class picks to file your taxes.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

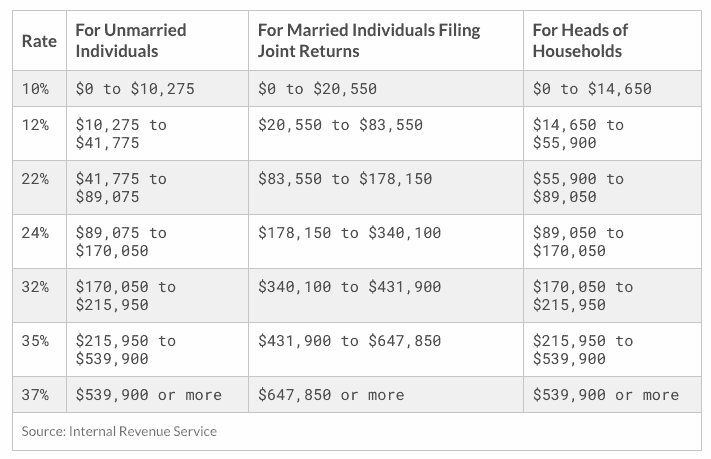

The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

. 15 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. Free tax filing software will find your tax bracket for 2021 with guaranteed accuracy. The income brackets though are adjusted slightly for inflation.

Your 2021 Tax Bracket To See Whats Been Adjusted. 10 marginal rate 10276 to 41775. See it in action.

If youre already a subscriber to the Tax Reduction Letter you will be prompted to log in when you. 32 for incomes over 170050 340100 for married couples filing jointly. Your bracket depends on your taxable income and filing status.

Taxable income up to 20550 12. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 35 for incomes over 215950 431900 for married couples filing jointly.

15 hours ago2022 tax brackets for individuals Individual rates. The IRS update includes dozens of other changes including adjustments to earned income tax credits. For married individuals filing jointly.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Avalara calculates collects files remits sales tax returns for your business. Here are the new brackets for 2022 depending on your income and filing status.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above. To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax brackets 2021 tax brackets Full 2022 tax rates schedules and contribution limits PDF Log in to get. That puts the two of you in the 24 percent federal income tax bracket.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends at 89075. Ad Compare Your 2022 Tax Bracket vs. Ad Smart Technology Easy Steps User Friendly - 48 Star Loyal Customer Rating.

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140 24 tax on the. Discover Helpful Information And Resources On Taxes From AARP. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

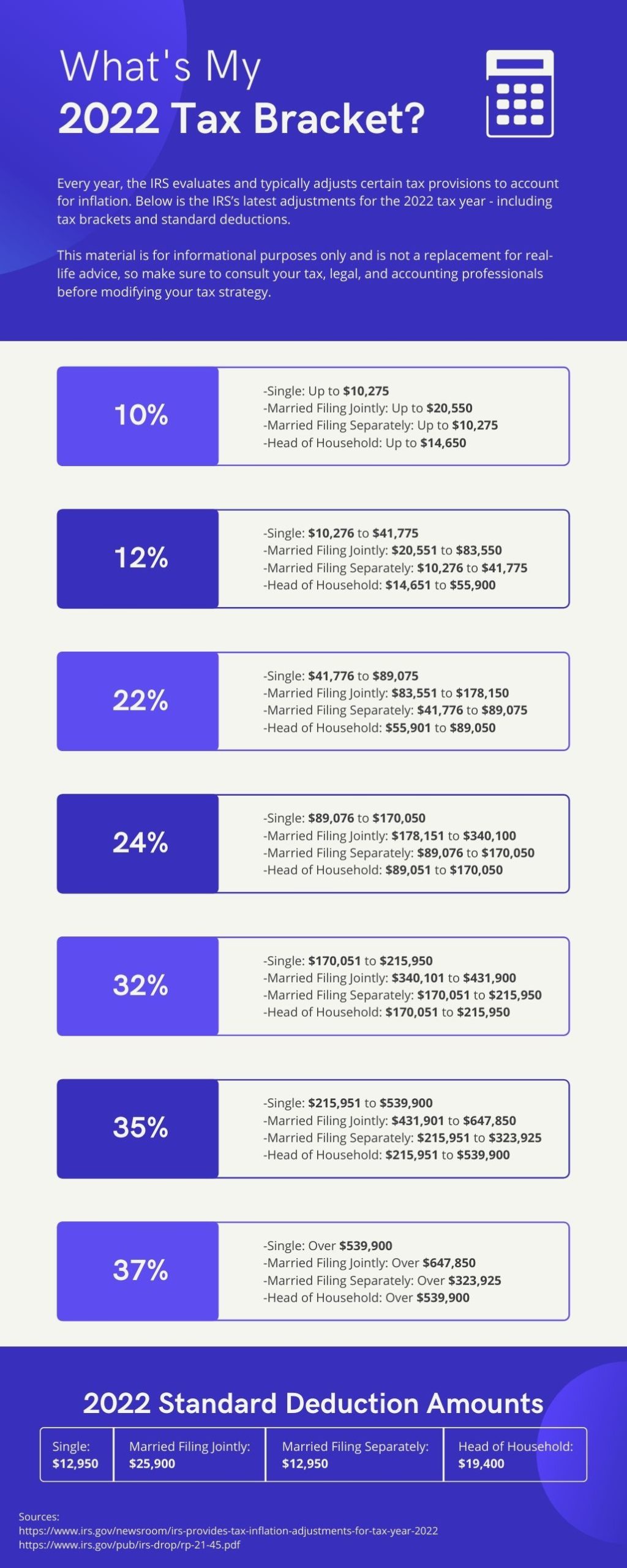

Below you will find the 2022 tax rates and income brackets. Single filers may claim 13850 an increase from 12950. 22 for incomes over 41775 83550.

These are the rates for. 12 41776 to 89075. Here are the 2022 Federal tax brackets.

If you can find 10000 in new deductions you pocket 2400. There are seven federal tax brackets for the 2021 tax year. 1828 enacted in 2021 reduces rates and the number of brackets for Tax Year 2022.

24 for incomes over 89075 178150 for married couples filing jointly. 13 hours agoThe 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

Whether you are single a head of household married etc. 1 day ago32 for incomes over 182100 364200 for married couples filing jointly 24 for incomes over 95375 190750 for married couples filing jointly 22 for incomes over 44725 89450 for. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022 to December 31 2022.

Up from 6935 for tax year 2022. Federal Income Tax Brackets 2022. You and your spouse have taxable income of 210000.

Ad Avalara AvaTax lowers risk by automating sales tax compliance. The federal income tax rates for 2022 did not change from 2021. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550.

However for head-of-household filers it goes from 55901 to 89050. The 24 bracket for. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service.

The bracket adjustment amount starts at 610 for individuals with net income of 84501 and decreases by 10 for every 100 in additional net income. So for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022. 20 hours agoThe standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

Taxable income between 20550 to. Federal income tax brackets were last changed one year ago for. The table below shows the tax bracketrate for each income level.

There are seven federal income tax rates in 2022. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. Heres a breakdown of last years income and rates.

This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022. 10 12 22 24 32 35 and 37. 18 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023. Each of the tax brackets income ranges jumped about 7 from last years numbers.

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Tax Changes For 2022 Including Tax Brackets Acorns

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What S My 2022 Tax Bracket Infographic Delphi Advisers Llc

Income Tax Brackets For 2022 Are Set

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Income Tax Statistics 2022 Tax Brackets Usa Uk And More

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

2022 Income Tax Brackets And The New Ideal Income

What S My 2022 Tax Bracket Green Retirement Inc

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn

2022 2023 Tax Brackets Rates For Each Income Level

March 4 2022 2022 Small Business Tax Brackets Explained Gusto